》Check SMM copper quotes, data, and market analysis

》Subscribe to view historical spot prices of SMM metals

》Click to view SMM copper industry chain database

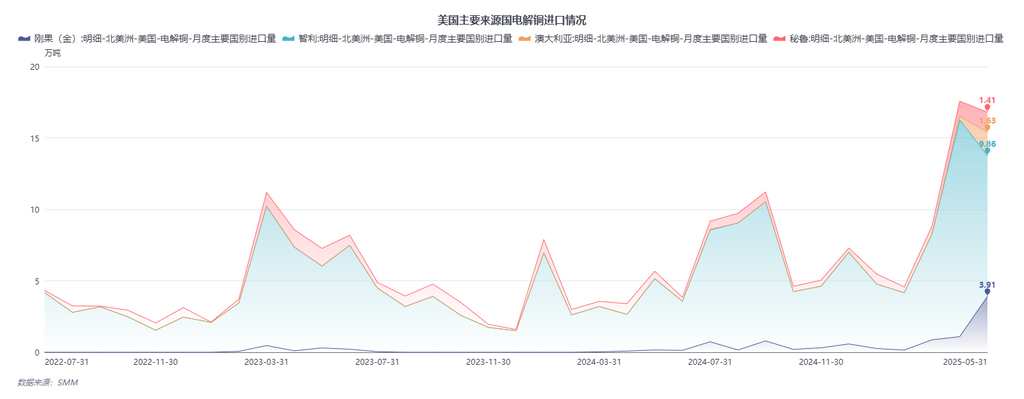

On February 26, 2025, US President Trump signed an executive order directing the Department of Commerce to initiate an investigation under Section 232 of the Trade Expansion Act of 1962 ("232 Investigation") into whether copper imports threaten national security. The 232 Investigation typically includes a 270-day investigation period by the Department of Commerce and a 90-day decision-making period by the President, originally scheduled to conclude by the end of November. The scope of the investigation covers raw copper ore, concentrates, copper scrap, copper alloys, and various derivative products. On July 8, 2025, Trump announced the conclusion of the investigation and planned to impose a 50% tariff on all imported copper starting from August 1. This tariff level far exceeded the market's previous expectation of 25% and was implemented significantly earlier than anticipated.

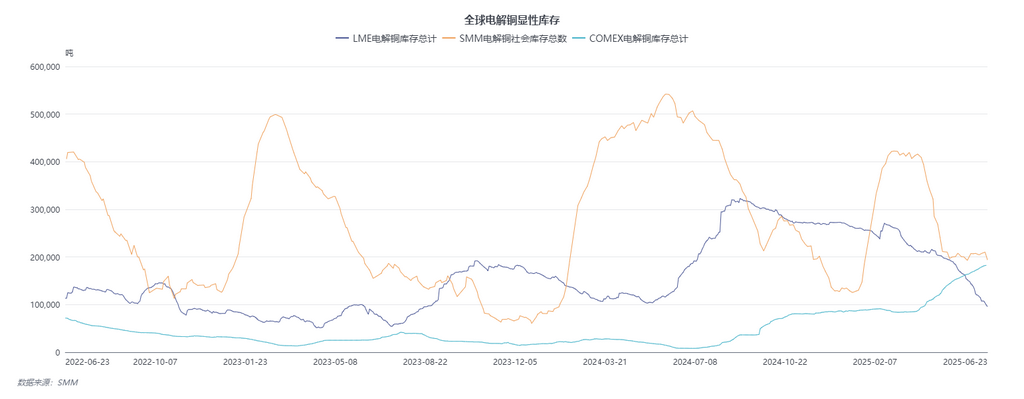

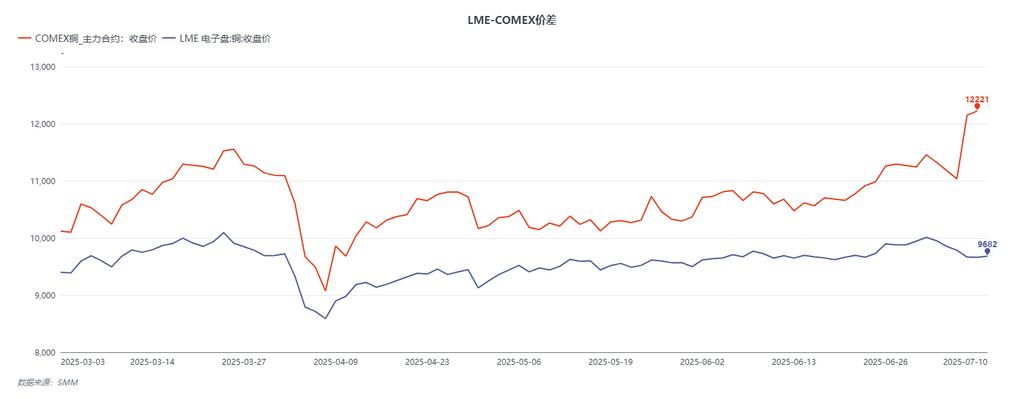

Upon the announcement of the tariff, COMEX copper prices surged to a record high (COMEX 07 contract reached a peak of $5.68/lb), with a gain exceeding 13%; LME 3M copper prices, however, fell to around $9,600/mt due to expectations of suppressed US demand, resulting in a rapid widening of the price spread between the two markets to over $2,500/mt. Market perspectives suggest that the US's siphoning effect has weakened, with expectations for improved spot supply on the LME, and the market structure quickly shifted to Contango. Due to the significant decline in LME copper, the LME-SHFE import price ratio has been restored.

It appears that the script of the US siphoning electrolytic copper in the first half of the year is nearing its end, but upon closer inspection, there are many unclear details about this sudden tariff decision. Firstly, the scope of the tariff remains unclear—whether the 50% tariff applies to all copper products (copper cathode, semi-finished products, processed materials, etc.) or only to specific categories. Secondly, the timing of the tariff applicationhas not been clarified—whether it will be based on the shipment (loading) time of the goods or the arrival time of the B/L. The applicable countries have also not been determined—whether the tariff will be applied uniformly to all countries,or whether there will be exemptions or differential treatment for specific source countries (such as Chile, Canada, Mexico).Regarding the current situation in the US, the annual demand for electrolytic copper in the US is approximately 1.5–1.6 million mt, with about 800,000–900,000 mt relying on imports. In 2024, the imported volume of electrolytic copper was 810,000 mt; from January to June 2025, the cumulative imports were approximately 650,000–680,000 mt. In line with the Trump administration's direction of "reshoring manufacturing" and "localizing the industry chain," the current spot and in-transit inventories are clearly insufficient to sustainably meet the stable demand for electrolytic copper in the US manufacturing sector after the imposition of a 50% tariff.

Based on the assumption that the US imposes a 50% tariff on all source countries, the following scenarios are projected for the potential future direction of spot trade: If the tariff implementation time is based on the shipment time of the goods, driven by the extremely large price spread between LME and COMEX, all global electrolytic copper inventories and unreported inventories may be concentrated and shipped to the US before the tariff officially takes effect; electrolytic copper supply in non-US regions will experience a short-term vacuum, with offshore electrolytic copper premiums surging sharply in the short term before gradually returning to normal. If the tariff implementation time is based on the arrival time, the US's space for stockpiling in advance will be limited, the siphoning effect will weaken, global trade flows will return to normal, LME inventories will gradually recover, and the supply tightness of electrolytic copper in non-US regions such as Asia will be alleviated.

Looking ahead, as LME copper prices decline and the SHFE/LME price ratio recovers, the domestic import arbitrage window will close, and the willingness of coastal smelters to export will decline. Smelters will increasingly turn to domestic sales or long-term contract deliveries, and the spot supply in the domestic market is expected to rise further. Some suppliers believe that the current near-month BACK structure of SHFE copper, which is formed due to low inventory, is difficult to sustain, and there are already signs of a significant drop in spot premiums. If near-month contracts shift to backwardation or turn into contango in the future, it may lead to structural adjustments in spot prices and delivery warrants.